Welcome to the journey to financial wellness where we learn the secrets to mastering your money: essential steps for financial wellness. This introductory section provides a concise overview of the importance of achieving financial wellness and explores its profound impact on individuals and overall well-being.

What is Financial Wellness?

Financial wellness is like a puzzle and the pieces are financial literacy, budgeting, saving, investing and debt management. Understanding these parts will give you the tools to navigate the world of personal finance.

Financial well-being basically means a financial state where income and expenses are balanced and there is a sense of financial security. It’s not just about the amount of money you have; it’s how well you manage it, save it and grow it to support your life goals.

The Interconnection of Financial and Overall Wellness

Financial wellness isn’t just about numbers; is a key factor in a balanced and fulfilling life. Your financial well-being directly affects your physical health, mental well-being and the quality of your relationships. A solid financial foundation is the cornerstone in building a life full of opportunities.

Essential steps for financial wellness

Budgeting: The Blueprint of Financial Success

Creating a budget is similar to creating a plan for your financial success. This includes strategic planning and allocating your income to expenses, savings and investments. By creating a budget, you can manage your money and make sure every dollar has a purpose.

Saving: Planting Seeds for a Secure Future

Savings is the basis of financial stability. It is not just about transferring money; it means forming a habit that allows you to achieve short-term goals and provides a safety net for unexpected situations. Learn how to grow your savings for long-term benefits.

Investing: Growing Your Financial Garden

Investing is the art of making your money work for you. Learn the basics of investment opportunities, understand risk and return, and learn how to grow a diversified financial portfolio. Investing is an important step in building wealth and achieving your long-term financial goals.

Debt Management: Breaking Free from Financial Shackles

Debt is a double-edged sword. Learn the difference between good and bad debt, develop effective debt strategies and free yourself from the financial burden. Effective debt management is critical to maintaining a healthy financial life.

Emergency Fund: Your Financial Safety Net

Life is unpredictable and crises can strike when you least expect it. An emergency fund acts as your financial safety net, providing peace of mind and stability during difficult times. Learn about the importance of building and maintaining this important cushion.

Understanding these parts is how to get the tools you need for your financial journey. In the next section, we’ll explore how to assess your current financial situation, a critical step toward true financial wellness.

Assessing Your Current Financial Situation

Embarking on the path to financial wellness requires a clear understanding of your starting point. This section describes the most important steps to take to assess your current financial situation and lay the foundation for a successful future.

Conducting a Financial Health Check

Before you can plan the direction of your financial well-being, it is necessary to conduct a thorough examination of your financial situation. This requires an investigation of assets, liabilities and overall financial position. Ask yourself questions like:

- Do I have any investments or savings accounts?

- Are there outstanding loans or credit card balances?

- What are my current assets and debts?

This financial health check acts as a compass to guide you to areas that may need attention and improvement. This is the first step to achieving a stable financial profile.

Analyzing Income and Expenses

Understanding the fluctuations of your finances is crucial. Start documenting your sources of income, including salary, bonuses or other sources of income. Next, carefully list all expenses—from things like rent and utilities to discretionary expenses for entertainment and eating out. By analyzing your income and expenses, you get a clear picture of your spending habits. This overview will help you create a realistic budget that will help you strategically allocate money to meet your financial goals.

Identifying Financial Goals

What are your financial aspirations? Setting clear and achievable goals is the compass that guides your financial journey. Whether you’re saving for your dream vacation, buying a home, or building a nest egg, knowing your destination can help you plan an efficient itinerary.

Take the time to distinguish between short-term and long-term goals. Short-term goals might be building an emergency fund or paying off a credit card, while long-term goals might be buying a home or enjoying a comfortable retirement.

By clearly defining your financial goals, you create a foundation for making purposeful and focused financial decisions. Ahead, we’ll delve into the practical steps of budgeting, a powerful tool for turning your financial goals from dreams into concrete realities.

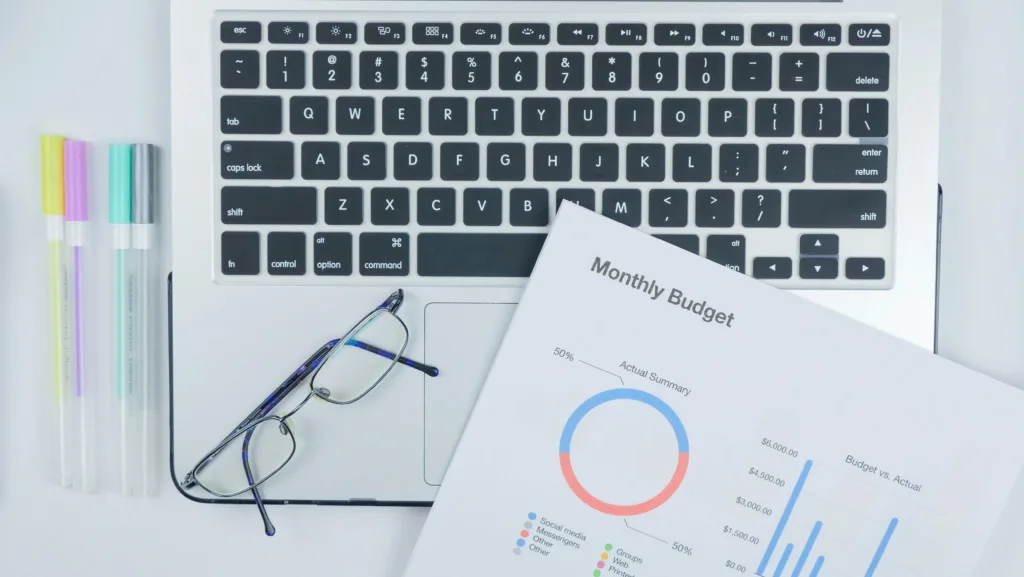

Creating a Budget

Now that we’ve assessed our financial situation, it’s time to create a road map to success – a budget. This section discusses the importance of budgeting, provides step-by-step instructions for budgeting, and shares practical tips for budgeting.

Importance of Budgeting

Budgeting is a cornerstone of financial stability and provides a clear overview of your income, expenses and savings. Here’s why it’s a game changer:

- Financial Control: A budget puts you in control of your money and determines where every dollar goes.

- Goal Attainment: This aligns your spending with your financial goals and makes dreams like home ownership, travel or education attainable.

- Emergency Preparedness: A budget ensures that you have funds set aside for unexpected expenses, which acts as a financial safety net.

Budgeting is not fundamentally about limitations; it’s a liberating tool that will lead you to financial freedom.

Step-by-Step Guide to Creating a Budget

- Calculate your income: Start by adding up all your sources of income – salary, freelance work or other additional income.

- List your expenses: Classify your expenses into fixed (mortgage, rent) and variable (groceries, entertainment). Be careful when calculating all the costs.

- Set Financial Goals: Set short and long term goals. Allocate money to each goal and make sure your budget meets your needs.

- Create Categories: Divide expenses into categories such as housing, utilities, transportation, and entertainment. It brings clarity and organization.

- Allocate Funds: Allocate specific amounts to each category based on your income and financial goals. Be realistic and prioritize.

- Track your expenses: track your expenses regularly against your budget. This will help identify areas where adjustments may be needed.

- Adjust as needed: Life is dynamic and so is your budget. Customize classes and assignments based on your financial situation or goals.

Tips for Sticking to a Budget

- Emergency Fund: Include an emergency savings category in your budget so you can handle unexpected expenses without derailing your financial plan.

- Review Regularly: Schedule regular reviews of your budget. This ensures that it remains in line with your goals and reflects changes in your financial situation.

- Be realistic: set achievable spending limits. Limiting yourself too much can lead to frustration and increase your chances of going beyond your budget.

- Use technology: Use budgeting apps and tools to make the process easier. Many apps automatically categorize your expenses and provide real-time statistics.

- Reward yourself: Celebrate milestones and financial gains. Acknowledging your progress can increase your motivation to stick to your budget.

As we move forward in our journey to financial wellness, the next crucial step is to build an emergency fund—a financial cushion to protect you from unexpected challenges.

Building an Emergency Fund

In the unpredictable journey of life, economic storms can strike unexpectedly. This is where an emergency fund becomes your financial roof. This section explores the importance of an emergency fund, determining the right amount, and practical strategies for building and maintaining one.

Importance of an Emergency Fund

An emergency fund is not just a financial cushion; it is your safety net in times of uncertainty. That is why it is an undeniable part of financial well-being:

- Unforeseen Expenses: Life is full of surprises, and not all of them are pleasant. An emergency fund provides immediate help for unexpected expenses, such as medical bills, car repairs or home maintenance.

- Job Loss or Loss of Income: An emergency fund ensures that you can cover your essential expenses while you are going through difficult times.

- Reduced stress: Financial stress can affect mental and physical health.

An emergency fund provides peace of mind, enabling you to flexibly face challenges.

Determining the Right Amount for Your Emergency Fund

The ideal size of your emergency fund depends on several factors, including monthly expenses, job stability and lifestyle. Here’s a simple guide to determining the right amount:

- Calculate Essential Expenses: Determine your monthly essential expenses, including rent or mortgage, utilities, groceries and insurance.

- Multiply by the number of months: Multiply this monthly out-of-pocket amount by the number of months you will feel covered in an emergency. The general recommendation is three to six months and the cost of living.

- Consider individual factors: Adjust the amount according to your individual circumstances. People with stable employment may tend to a lower result, while people with variable income or weaker employment may tend to a larger fund.

Strategies for Building and Maintaining an Emergency Fund

- Start small, start now: don’t get overwhelmed; Start by regularly investing a small portion of your income. Consistency is key.

- Automate Savings: Set up an automatic transfer to your emergency fund every time you get paid. This ensures that you save first.

- Use Windfalls Wisely: Channel windfalls like tax refunds or bonuses directly into your emergency fund.

- Cut unnecessary expenses: Analyze your spending habits and identify areas where you can cut back. Direct these funds to your emergency fund.

- Make debt repayment a priority: Continue to pay down minimal debt while building an emergency fund. When your fund reaches a sufficient level, allocate more funds to repay debts.

- Reassess and Adjust: Regularly assess your emergency fund and adequacy, especially after life changes such as changing jobs or changes in the cost of living.

Remember that an emergency fund is not a one-time achievement, but an ongoing commitment to your financial well-being. In the next segment, we’ll explore debt management strategies—an important step in managing your money..

Tackling Debt

Debt can cloud your financial well-being, but with strategic planning, you can rise into the light of financial freedom. This section explores understanding the different types of debt, creating a repayment plan, and exploring consolidation and debt management strategies.

Understanding Different Types of Debt

Not all debt is created equal. Understanding the nuances of different types of debt is the first step to overcoming them:

- Good Debt vs. Bad Debt: Understand the difference between good debt that can advance your financial future (like a mortgage) and debt that typically has high interest rates ( such as credit card debt).

- Credit Card Debt: One of the most common types of credit damage due to high interest rates. Make paying off outstanding credit card balances a priority.

- Student Loans: A considered investment in education, but necessary to manage repayments wisely.

- Home Loans: A long-term commitment that requires consistent payments but encourages equity building.

- Car loans: Although they are a necessary expense for many, remember the terms and rates.

Developing a Debt Repayment Plan

Once you identified your debts, it’s time to create a roadmap for repayment:

- List Your Debts: Compile a list of all outstanding debts, including the total amount owed, interest rates, and minimum monthly payments.

- Prioritize High-Interest Debts: Focus on paying off high-interest debts first to minimize overall interest payments.

- Snowball vs. Avalanche Method: Choose a repayment strategy that suits you. The snowball method involves paying off the smallest debts first, while the avalanche method prioritizes debts with the highest interest rates.

- Negotiate with creditors: explore options for lower interest rates or more favorable repayment terms.

- Set Realistic Goals: Set achievable milestones to track your progress and stay motivated.

Consolidation and Debt Management Strategies

Consolidation and management strategies can simplify the debt repayment process:

- Debt Consolidation Loans: Consolidating multiple debts into one low-interest loan can make repayment more manageable.

- Balance Transfers: Transferring high-interest credit card balances to a lower-interest card can save you interest payments.

- Debt Management Plans (DMPs): Working with credit counseling agencies to create a DMP can help negotiate lower interest rates and consolidate payments.

- Snowflake Payments: Make small additional payments when possible. These “snowflakes” payments can speed up debt repayment.

- Budget Adjustments: Review your budget regularly to identify areas where you can allocate more money to pay down debt.

Remember that paying off debt is a marathon, not a sprint. Consistent work and strategic planning will lead you to financial freedom. In the next segment, we’ll explore the two pillars of saving and investing that are essential to building a strong financial foundation.

Saving and Investing

As we continue our journey to financial mastery, saving and investing become key steps to building wealth and securing your financial future. This section highlights the importance of saving, distinguishes between short-term and long-term goals, introduces basic investment options and the importance of professional financial advice.

The Importance of Saving for the Future

Saving lays the foundation for financial security and opens doors to future opportunities. That’s why making savings a habit is crucial:

- Emergency Preparedness: A solid savings account acts as a financial safety net that provides peace of mind during unexpected life events.

- Financial Goals: Whether buying a home, starting a business or furthering your education, saving is the key to making your dreams come true.

- Reduced Debt: A savings cushion helps avoid credit card or loan dependency during times of financial trouble.

- Financial Freedom: Accumulating savings gives you the freedom to make choices based on your desires, not financial constraints.

Differentiating Between Short-term and Long-term Goals

Understanding the time horizon of your goals is crucial when deciding where to allocate your savings:

- Short-Term Goals: These typically have a time frame of one to three years and can include saving for a vacation, creating an emergency fund, or making a significant purchase.

- Long-Term Goals: Spanning over three years, long-term goals involve saving for major life events such as homeownership, education, or retirement.

Distinguishing between these goals allows for tailored saving and investment strategies based on your unique aspirations.

Introduction to Basic Investment Options

Once you’ve built a solid savings fund, it’s time to explore the world of investments. Here’s an overview of the main investment options:

- Savings Accounts: Offer a safe and liquid option, albeit with a lower interest rate than other investments.

- Certificates of Deposits (CDs): Offer higher interest rates than savings accounts, but require your money to be locked up for a period of time.

- Shares: represent ownership in a company and can provide long-term capital appreciation.

- Bonds: debt securities that pay regular interest and return principal at maturity, providing a steady stream of income.

- Mutual funds: pools money from several investors to invest in a diversified portfolio of stocks, bonds or other securities.

- Exchange Traded Funds (ETFs): Similar to mutual funds, but traded on an exchange, offering versatility and flexibility.

Seeking Professional Financial Advice

Understanding the basic investment options is important. Seeking professional financial advice can improve your decision-making process:

- Financial Advisors: Connect with certified financial advisors who can provide personalized guidance based on your financial situation and goals.

- Investment Planners: Work with investment planners to create a customized investment strategy that meets your risk tolerance and goals.

- Educational Seminars: Attend financial educational seminars to expand your understanding of investment opportunities and strategies.

Remember that everyone’s financial journey is unique. Seeking professional advice will ensure that your investment choices meet your specific circumstances and desires.

In the next segment, we’ll explore how lifestyle choices affect financial well-being and provide guidance for finding the right balance between spending and saving.

Lifestyle Choices and Financial Wellness

Our daily choices shape not only our lives, but also our financial well-being. This section explores the impact of lifestyle choices, including the growing trend of minimalist living, on financial health. Weand discusses finding the delicate balance between spending and saving, explores the importance of making informed financial decisions, and discusses how a minimalist lifestyle can contribute to a more sustainable and financially conscious lifestyle.

Impact of Lifestyle Choices on Financial Well-Being

- Daily Habits: Small, consistent habits, such as daily coffee purchases or impulse shopping, can accumulate into significant expenses over time. Recognizing and adjusting these habits can positively impact your financial well-being.

- Housing Choices: The decision to rent or buy, choosing between urban and suburban living, and even home size can significantly influence your monthly expenses and long-term financial goals.

- Transportation: Your choice of transportation, whether it’s owning a car, using public transportation, or opting for ridesharing services, has financial implications. Consider the costs associated with each option and their impact on your budget.

- Socializing and Entertainment: While socializing and leisure activities are essential for a balanced life, overspending on dining out, entertainment, or events can strain your budget. Finding cost-effective alternatives can make a significant difference.

- Minimalist Living: Embracing a minimalist lifestyle involves intentional choices to simplify and declutter one’s life. This mindset shift can lead to reduced spending, increased savings, and a focus on experiences rather than material possessions.

Finding a Balance Between Spending and Saving

- Needs vs. Wants: Distinguishing between essential needs and discretionary wants is crucial. Prioritize spending on needs and allocate a portion of your budget for wants without jeopardizing your savings goals.

- Budgeting Tools: Leverage budgeting tools and apps to track your spending. These tools provide insights into your financial habits and help you identify areas where adjustments can be made.

- Emergency Fund: Maintain a healthy emergency fund to cover unforeseen expenses, allowing you to navigate unexpected financial challenges without derailing your overall financial plan.

- Set Realistic Goals: When setting financial goals, be realistic about your lifestyle and spending habits. Setting unattainable goals may lead to frustration and hinder your overall financial well-being.

Making Informed Financial Decisions

- Educate Yourself: Continuously educate yourself on personal finance topics. Understanding the principles of investing, debt management, and budgeting empowers you to make informed financial decisions.

- Seek Professional Advice: Consult with financial advisors to receive personalized guidance based on your unique situation. Their expertise can help you navigate complex financial decisions and plan for the future.

- Financial Literacy: Cultivate financial literacy not only for yourself but for your family. Educating your loved ones about sound financial practices contributes to a financially resilient household.

- Stay Informed: Keep yourself informed about economic trends, changes in tax laws, and other factors that may impact your financial decisions. Staying proactive ensures your financial plan remains adaptable and robust.

In the next section, we’ll explore the importance of regularly reviewing and adjusting your financial plan, celebrating milestones, and adapting to life changes. This ensures that your financial journey remains dynamic and aligned with your changing goals, even in the context of a minimalist life.

Monitoring and Adjusting Your Financial Plan

As you navigate the dynamic terrain of personal finance, it’s crucial to regularly monitor and adjust your financial plan. This section will guide you through the importance of reviewing financial goals, making adjustments based on life changes and achieved milestones, and celebrating key moments in your financial journey.

Regularly Reviewing Your Financial Goals

- Set Review Intervals: Establish regular intervals for reviewing your financial goals. This could be quarterly, bi-annually, or annually, depending on your preferences and the complexity of your financial situation.

- Evaluate Progress: Assess how far you’ve come in achieving your financial goals. Consider factors such as savings growth, debt reduction, and investment performance.

- Adjust Goals if Needed: Life is dynamic, and circumstances may change. If necessary, adjust your financial goals to align with evolving priorities, aspirations, or unexpected life events.

Adjusting the Plan Based on Life Changes and Financial Goals Achieved

- Life Changes: Major life events such as marriage, the birth of a child, job changes, or a significant increase in income can warrant adjustments to your financial plan. Reassess your budget, savings, and investment strategy to accommodate these changes.

- Debt Reduction: If you’ve made substantial progress in paying off debts, consider relocating those funds towards other financial goals, such as building an emergency fund, saving for a down payment, or increasing investments.

- Income Changes: A salary increase or additional income sources provide an opportunity to reassess your financial plan. Consider adjusting your budget, increasing savings contributions, or exploring new investment opportunities.

Celebrating Milestones in Your Financial Journey

- Recognize Achievements: Take the time to acknowledge and celebrate financial milestones. Whether it’s paying off a credit card, reaching a savings target, or successfully investing, recognizing achievements boosts morale and motivation.

- Reward Yourself Moderately: Treat yourself in moderation when reaching significant financial milestones. However, ensure that rewards align with your overall financial goals to avoid compromising progress.

- Share Your Success: Celebrate with loved ones and share your financial successes. Creating a supportive community around your financial journey adds an extra layer of motivation.

Remember, celebrating milestones is not just about the destination but also about appreciating the journey. The financial landscape is ever-changing, and your ability to adapt and celebrate progress is key to long-term success.

In our concluding section, we’ll wrap up our guide to mastering your money by providing additional resources to inspire and guide you on your ongoing journey towards financial wellness.

Resources and Tools for Financial Wellness

As you continue your journey towards financial wellness, leveraging the right resources and tools can enhance your understanding and management of personal finances. In this section, we’ll provide recommendations for books, websites, and apps for financial education, along with online tools to assist in budgeting, investing, and tracking expenses.

Recommended Books, Websites, and Apps for Financial Education

Books:

- The Total Money Makeover by Dave Ramsey: A practical guide to financial fitness, offering actionable steps to eliminate debt and build wealth.

- Your Money or Your Life by Vicki Robin and Joe Dominguez: Explores the relationship between money and life, providing a transformative approach to financial well-being.

- The Millionaire Next Door by Thomas J. Stanley and William D. Danko: Examines the habits and characteristics of millionaires, offering insights into building wealth.

Websites:

- Investopedia (investopedia.com): An extensive online resource covering a wide range of financial topics, from investing to personal finance.

- NerdWallet (nerdwallet.com): Offers comprehensive guides and tools for budgeting, credit cards, and investment decisions.

- The Motley Fool (fool.com): A reliable source for investment advice, market analysis, and educational content.

Apps:

- Mint: An all-in-one app for budgeting, expense tracking, and financial goal setting.

- Acorns: Rounds up your everyday purchases to invest the spare change, making investing simple.

- YNAB (You Need A Budget): Focuses on zero-based budgeting, helping you allocate every dollar towards a specific purpose.

Online Tools for Budgeting, Investing, and Tracking Expenses

- Budgeting Tools:

- YNAB (You Need A Budget): A powerful tool for zero-based budgeting, providing clarity on where your money is going and helping you plan for future expenses.

- EveryDollar: Dave Ramsey’s budgeting tool, designed to give you control over your money and align your spending with your financial goals.

- Investing Platforms:

- Robinhood: A user-friendly platform for commission-free stock and ETF trading, suitable for beginners.

- Vanguard: Known for its low-cost index funds and ETFs, offering a solid option for long-term investors.

- Expense Tracking:

- Expensify: Ideal for tracking business expenses, but can also be used for personal expense tracking.

- PocketGuard: Automatically tracks and categorizes expenses, providing insights into your spending habits.

Remember to explore these resources and tools, but also tailor your choices based on your individual preferences and financial goals. Continuous learning and informed decision-making will empower you on your journey to financial wellness. Congratulations on taking proactive steps towards mastering your money!

Conclusion

As we conclude our guide on “Mastering Your Money: Essential tips for Achieving Financial Wellness,” let’s recap the essential tips that can pave the way to a more secure and fulfilling financial future. It’s our hope that these insights and practical tips empower you to take control of your finances and embark on a journey towards lasting financial wellness.

Recap of Key Steps for Achieving Financial Wellness

- Understanding Financial Wellness:

- Define financial wellness and recognize its profound impact on your overall well-being.

- Explore the essential components, including budgeting, saving, investing, debt management, and maintaining an emergency fund.

- Assessing Your Current Financial Situation:

- Conduct a thorough financial health check to understand your assets, liabilities, and overall monetary standing.

- Analyze your income and expenses, identify financial goals, and lay the groundwork for your financial journey.

- Creating a Budget:

- Recognize the importance of budgeting in gaining control over your money.

- Follow a step-by-step guide to create a budget and receive practical tips for sticking to it.

- Building an Emergency Fund:

- Understand the significance of having an emergency fund as a financial safety net.

- Determine the right amount for your emergency fund and employ strategies for building and maintaining it.

- Tackling Debt:

- Differentiate between types of debt and develop a debt repayment plan.

- Explore consolidation and debt management strategies to free yourself from financial burdens.

- Saving and Investing:

- Embrace the importance of saving for the future and distinguish between short-term and long-term goals.

- Gain an introduction to basic investment options and the significance of seeking professional financial advice.

- Lifestyle Choices and Financial Wellness:

- Understand how daily lifestyle choices impact financial well-being.

- Find a balance between spending and saving, making informed financial decisions, and explore the benefits of minimalist living.

- Monitoring and Adjusting Your Financial Plan:

- Regularly review financial goals, adjusting them as needed based on life changes and achievements.

- Celebrate milestones in your financial journey, recognizing progress and maintaining motivation.

- Resources and Tools for Financial Wellness:

- Explore recommended books, websites, and apps for financial education.

- Utilize online tools for budgeting, investing, and tracking expenses to enhance financial management.

Encouragement for Readers to Take Control of Their Financial Future

In concluding this guide, we want to encourage you to view financial wellness as a journey, not a destination. The steps outlined here are tools to empower you, but the real key lies in taking consistent, intentional action. Your financial future is within your control, and every small step you take today contributes to a more secure and prosperous tomorrow.

Remember, financial wellness is not about perfection but progress. Embrace the learning process, adapt to life changes, and celebrate your victories along the way. By mastering your money, you’re not just securing your financial future; you’re unlocking the potential for a life filled with opportunities, freedom, and peace of mind.

Thank you for embarking on this journey with us. Here’s to your financial success and a brighter future!